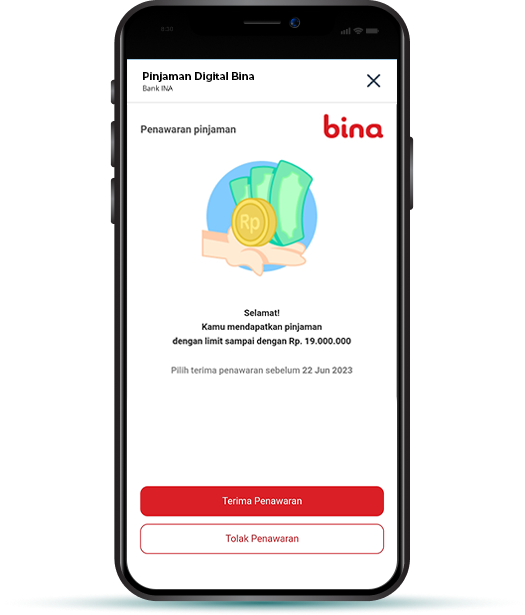

Digital Loan Bina

Additional funds for your business that can be disbursed at any time.

- Loan limit up to 25 Million IDR

- Tenor options from 14 days to 3 months

Additional funds for your business that can be disbursed at any time.

You will be charged an administration fee for every disbursement you make. This Administration Fee will automatically be deducted from your loan principal. You can see the pricing here.

Your application will be processed for a maximum of 3 working days since the credit application form is completed.

You can use Digital Loan Bina at partners that collaborating with Bank Ina. Currently, Bank Ina is collaborating with:

Sign up now and enjoy the ease of banking services for your business with Bina.